Page 10 - TBRA_Intake

P. 10

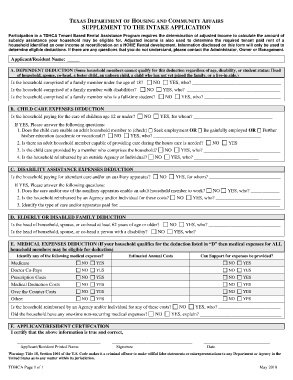

TEXAS DEPARTMENT OF HOUSING AND COMMUNITY AFFAIRS

SUPPLEMENT TO THE INTAKE APPLICATION

Participation in a TDHCA Tenant Based Rental Assistance Program requires the determination of adjusted income to calculate the amount of

subsidy assistance your household may be eligible for. Adjusted income is also used to determine the required tenant paid rent of a

household identified as over income at recertification on a HOME Rental development. Information disclosed on this form will only be used to

determine eligible deductions. If there are any questions that you do not understand, please contact the Administrator, Owner or Management.

Applicant/Resident Name:

A. DEPENDENT DEDUCTION (Some household members cannot qualify for this deduction regardless of age, disability, or student status: Head

of household, spouse, co-head, a foster child, an unborn child, a child who has not yet joined the family, or a live-in aide.)

Is the household comprised of a family member under the age of 18? NO YES, who? _____________________________________

Is the household comprised of a family member with disabilities? NO YES, who? _______________________________________

Is the household comprised of a family member who is a full-time student? NO YES, who? ________________________________

B. CHILD CARE EXPENSES DEDUCTION

Is the household paying for the care of children age 12 or under? NO YES, for whom? _________________________________

If YES, Please answer the following questions:

1. Does the child care enable an adult household member to (check) Seek employment OR Be gainfully employed OR Further

his/her education (academic or vocational)? NO YES, who? _____________________________________________

2. Is there an adult household member capable of providing care during the hours care is needed? NO YES

3. Is the child care provided by a member who comprises the household? NO YES, who? ________________________________

4. Is the household reimbursed by an outside Agency or Individual? NO YES, who? ___________________________

C. DISABILITY ASSISTANCE EXPENSES DEDUCTION

Is the household paying for attendant care and/or an auxiliary apparatus? NO YES, for whom? ______________________________

If YES, Please answer the following questions:

1. Does the care and/or use of the auxiliary apparatus enable an adult household member to work? NO YES, who? ____________

2. Is the household reimbursed by an Agency and/or Individual for these costs? NO YES, who? ___________________________

3. Identify the type of care and/or apparatus paid for: ___________________________________________________________________

D. ELDERLY OR DISABLED FAMILY DEDUCTION

Is the head of household, spouse, or co-head at least 62 years of age or older? NO YES, who? ______________________________

Is the head of household, spouse, or co-head a person with a disability? NO YES, who? ___________________________________

E. MEDICAL EXPENSES DEDUCTION (If your household qualifies for the deduction listed in “D” then medical expenses for ALL

household members may be eligible for deduction)

Identify any of the following medical expenses? Estimated Annual Costs Can Support for expenses be provided?

Medicare NO YES NO YES

Doctor Co-Pays NO YES NO YES

Prescription Costs NO YES NO YES

Medical Deduction Costs NO YES NO YES

Over the Counter Costs NO YES NO YES

Other: NO YES NO YES

Is the household reimbursed by an Agency and/or Individual for any of these costs? NO YES, who? __________________________

Did the household have any one-time non-recurring medical expenses? NO YES, explain? __________________________________

F. APPLICANT/RESIDENT CERTIFCATION

I certify that the above information is true and correct,

_____________________________ ____________________________ _______________________

Applicant/Resident Printed Name Signature Date

Warning: Title 18, Section 1001 of the U.S. Code makes it a criminal offense to make willful false statements or misrepresentations to any Department or Agency in the

United States as to any matter within its jurisdiction.

TDHCA Page 1 of 1 May 2010